Retirement is often seen as a time to relax and enjoy life, but not all states offer the idyllic retirement lifestyle many dream of. Some states present unique challenges for retirees, including high costs of living, poor healthcare access, and unfavorable tax structures. In this blog post, we explore 15 states that may be less than ideal for retirees, highlighting the specific issues each presents and providing insights into what makes them less appealing destinations for retirement.

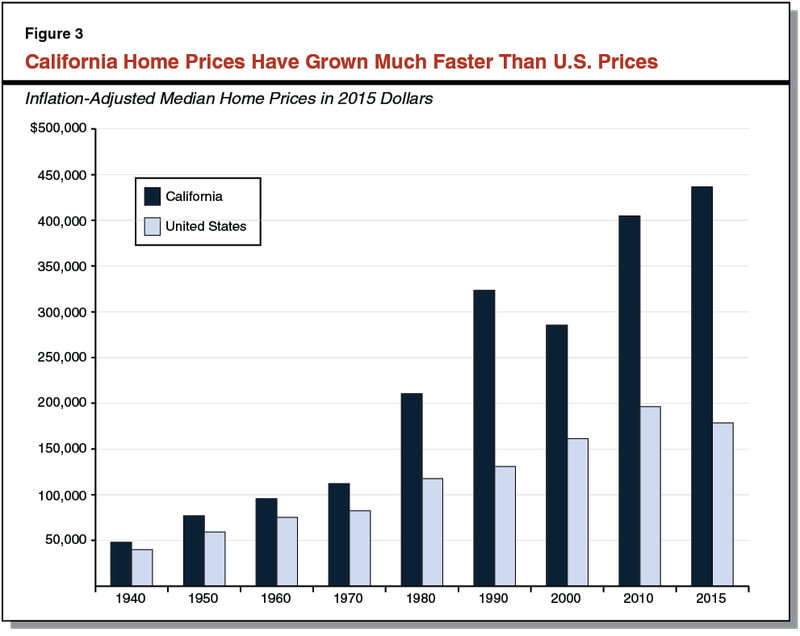

California

California may conjure images of sunny beaches, but retirees might find its high cost of living unsettling. Housing prices in cities like San Francisco and Los Angeles are astronomical, leaving many stretched thin financially.

Additionally, California imposes a high state income tax, adding further strain to fixed retirement incomes.

Beyond financial concerns, California’s healthcare system, though advanced, can be prohibitively expensive for some, creating additional hurdles for retirees seeking affordable care.

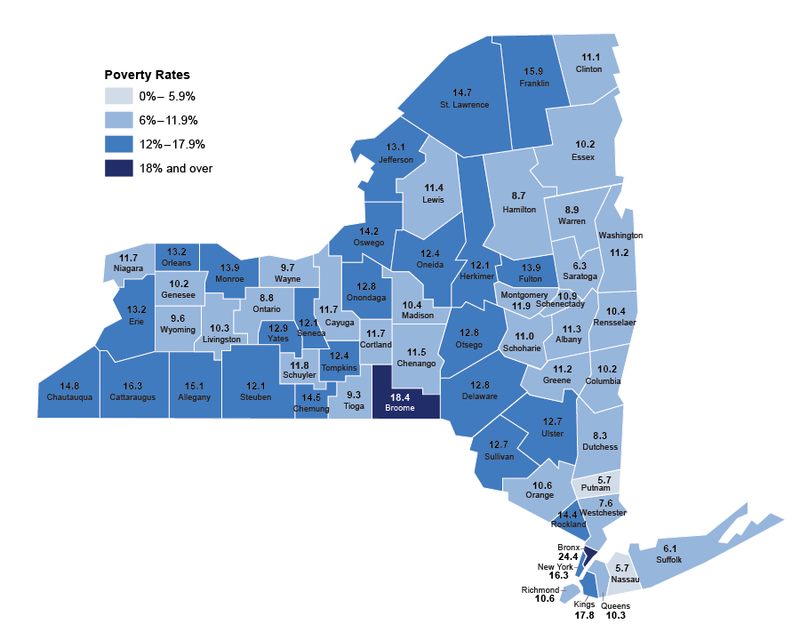

New York

New York State’s bustling urban centers are not always retiree-friendly. While cultural attractions are plentiful, the high cost of living, especially in New York City, can be a major drawback.

Retirees might struggle with high property taxes and rental costs, which can consume a significant portion of their income.

Weather in upstate New York can be harsh, with long winters that may not appeal to those seeking a milder climate.

Hawaii

Hawaii’s natural beauty is indisputable, yet living there can be a financial strain for retirees. The islands are known for their high cost of living, particularly when it comes to housing and groceries.

Importing goods leads to inflated prices, making everyday expenses daunting.

Healthcare access can also be limited on some islands, posing challenges for retirees needing regular medical attention.

New Jersey

New Jersey’s proximity to major cities like New York and Philadelphia contributes to its high property taxes, which can be overwhelming for retirees.

Though the state offers rich cultural and recreational activities, the financial burden of maintaining a home can be significant.

Additionally, New Jersey’s harsh winters might not appeal to those seeking a milder climate during their retirement years.

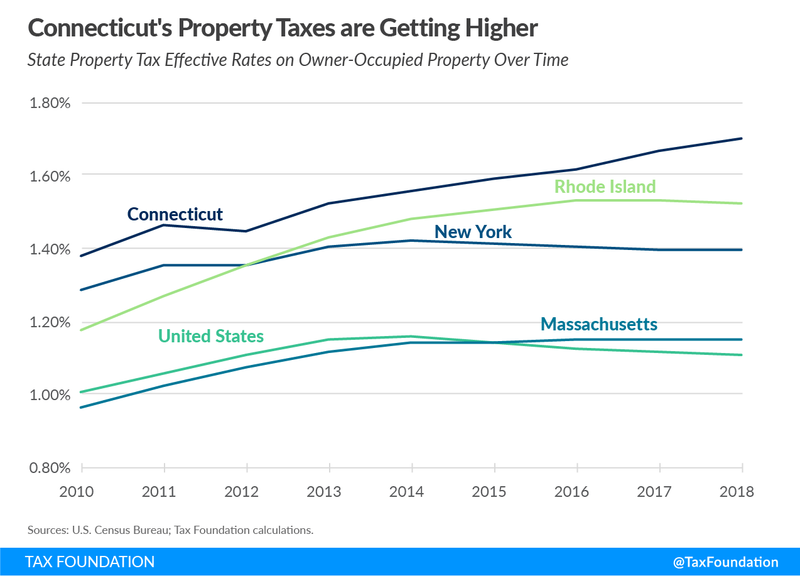

Connecticut

Connecticut offers picturesque landscapes and charming towns, but retirees may find its tax policies challenging.

The state imposes high taxes on income and property, which can eat into retirement savings.

Additionally, while healthcare quality is high, the costs associated with medical care can be substantial, potentially impacting retirees’ financial security.

Massachusetts

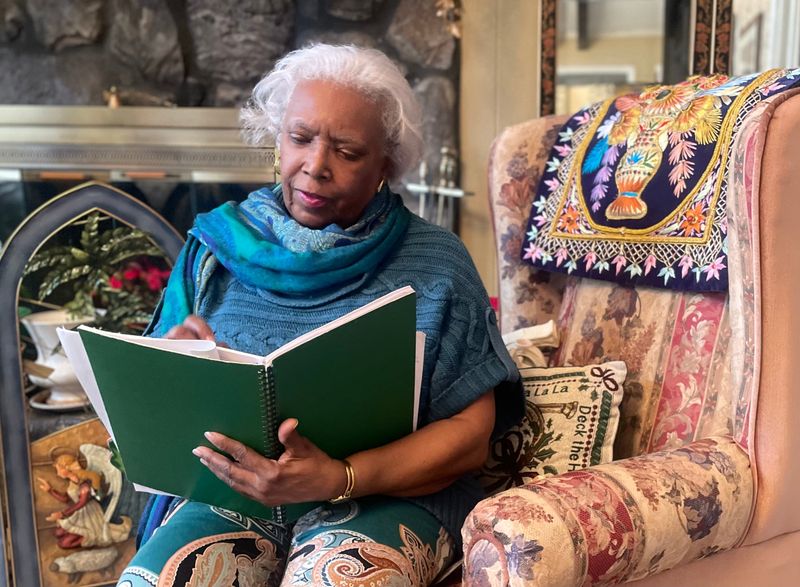

Massachusetts, with its rich history and vibrant culture, also presents challenges for retirees. The cost of living is high, especially in Boston, where housing and healthcare expenses can be prohibitive.

The state’s tax structure can also be complex, adding stress to financial planning.

Despite excellent healthcare facilities, the costs associated with them can deter those on a fixed income.

Vermont

Vermont’s serene landscapes may seem ideal, but its long, bitter winters can be daunting for retirees.

Heating costs can skyrocket, adding a significant burden to those on a fixed income.

Furthermore, Vermont’s remote nature can mean limited access to healthcare facilities, posing a challenge for retirees needing regular medical attention.

Alaska

Alaska offers stunning natural beauty, yet its harsh climate and remoteness can be challenging for retirees.

The cost of living is high due to the expense of importing goods, and healthcare access is often limited.

For those used to urban conveniences, Alaska’s isolation can feel overwhelming, making it less desirable for retirement living.

Rhode Island

Rhode Island, with its charming coastal towns, also bears a heavy tax burden for retirees.

The state levies significant taxes on retirement income, which can strain financial resources.

While the scenery is beautiful, the cost of living, particularly property and sales taxes, can deter those seeking a relaxed retirement.

Maryland

Maryland’s rich history and proximity to Washington D.C. come with a high cost of living, especially in terms of property taxes.

Retirees may find maintaining a home financially burdensome, impacting their quality of life.

Additionally, Maryland’s healthcare costs, while reflecting high standards, can be a significant expense for those on a fixed income.

Illinois

Illinois presents a mixed bag for retirees, with some areas offering affordable living but others burdened by high taxes.

The state’s financial woes have led to increased property taxes, which can be a heavy burden on retirees.

Additionally, while Chicago offers access to excellent healthcare, the costs can be steep, affecting those with limited budgets.

Maine

Maine’s picturesque scenery comes at a cost, with long, harsh winters that can be tough on retirees.

Heating bills can be substantial, adding financial stress to those with fixed incomes.

Moreover, healthcare access in rural areas can be limited, posing challenges for retirees needing consistent medical care.

Minnesota

Minnesota’s winters are notoriously cold, posing a challenge for retirees unaccustomed to such extremes.

Heating costs can soar, making budgeting difficult for those on a fixed income.

While the state offers excellent healthcare, the associated costs can be a concern, especially for retirees seeking affordable living options.

Alabama

Alabama might be warm, but its retirement scene is cooled by less favorable tax policies.

The state taxes both Social Security and pension income, potentially straining retirees’ budgets.

While the cost of living is generally lower, these taxes can negate some of the financial benefits, making it a complex place for retirement planning.

Kentucky

Kentucky offers beautiful landscapes, yet its healthcare system can be challenging for retirees.

Access to quality care in rural areas is often limited, leading to potential health risks for retirees.

Additionally, though the cost of living is relatively low, healthcare expenses can be significant, affecting overall financial stability.