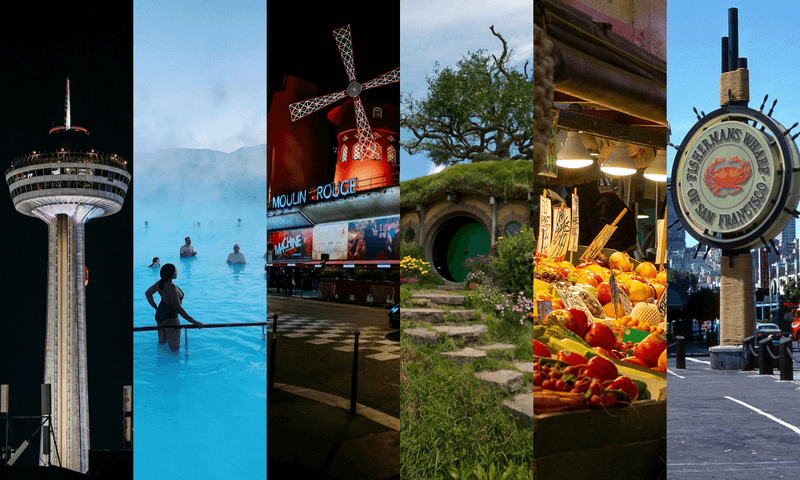

I stuck to the plan. I budgeted every dollar. I meal-prepped, cut subscriptions, and even used cash envelopes. But the moment I set foot on vacation? Temptation everywhere. And while I tried to channel my inner Dave Ramsey, these 9 sneaky vacation traps nearly wrecked months of smart money moves. Here’s what to watch for—so you don’t blow your hard-earned budget on the beach.

1. “Free” Hotel Upgrades That Weren’t So Free

They offered me an ocean view for “just $50 more a night.” It sounded like a deal—until I realized I’d just added $350 to my trip without blinking. Dave would’ve walked away. I didn’t. The allure of the crashing waves and the promise of serenity was hard to resist. What seemed like a minor luxury spiraled into a financial headache. That initial thrill of an upgrade was short-lived, replaced by budget panic. It’s astounding how quickly small decisions can balloon into major expenses. I learned the hard way that peace of mind sometimes comes with a hefty price tag.

2. Tour Packages That Guilt You Into Spending

A cheerful guide convinced me to “experience the real city” with a $120 walking tour that included lunch at a “local spot.” Spoiler: the lunch was overpriced, and the tour guide owned the restaurant. The promise of an authentic adventure was tempting. Yet, beneath the charisma lay a cleverly disguised sales pitch. As I dug into the meal, realization dawned—a tourist trap, packaged as culture. The guide’s friendly demeanor masked a profit-driven motive. My quest for genuine experiences was exploited. Next time, I’ll trust my instincts over practiced smiles.

3. Souvenir Shops That Weaponize Nostalgia

I don’t need six fridge magnets or a novelty mug shaped like a volcano. But in the moment, it felt like I’d regret not buying them. Dave says, “Memories aren’t for sale.” I forgot that. The allure of tangible memories tugged at my heartstrings. Each trinket whispered tales of adventure and fun, blurring needs and wants. Nostalgia became a costly companion. As I left the shop, bags heavier than planned, I realized I was paying for sentimentality. I learned that memories reside in experiences, not objects. A lesson heavy on emotion, light on logic.

4. “Split It With Friends” Traps

Traveling in a group sounds smart—until you end up splitting Ubers, meals, and “group excursions” that you didn’t even want. Suddenly you’re $300 lighter and too polite to complain. The camaraderie of shared adventures quickly turned into financial strain. Each shared expense was a silent tug-of-war between friendship and frugality. What began as a cost-saving strategy unfolded into an unexpected budgetary black hole. Personal preferences vanished in the tide of group consensus. My wallet bore the brunt of unvoiced objections. A reminder that financial harmony often requires clear communication.

5. Airport Food That Bleeds Your Wallet Dry

I thought I was in the clear…until I got to the airport. A sandwich, a drink, and a snack somehow totaled $28. “Plan ahead,” Ramsey says. I didn’t. The sterile airport environment masked exorbitant prices. Convenience came at a premium I wasn’t prepared for. Each bite of the overpriced snack left a bitter taste in my mouth. The allure of easy access clouded my judgment. With every purchase, my budget cringed. A stark reminder that forethought saves both stress and money. Next time, packing snacks will be my pre-flight ritual.

6. All-Inclusive Excuses to Overindulge

I thought prepaying would keep me from spending. Instead, I treated the resort like a 24/7 buffet and kept tipping like a millionaire. Turns out, “all-inclusive” doesn’t mean “budget-proof.” The illusion of unlimited access disguised the financial trap. Each indulgence felt justified, reinforcing a dangerous spending cycle. The convenience of having everything at hand blurred my budgetary boundaries. As the vacation ended, the reality of my spending hit hard. I realized that ‘all-inclusive’ required restraint, not reckless indulgence. This escapade taught me that true freedom involves mindful spending.

7. Spontaneous Excursions That Blew the Budget

A zip-line here, a boat ride there, and suddenly I was $500 deep in “YOLO” experiences. Yes, they were fun—but they were never part of the plan. And they hurt more after the trip. The thrill of spontaneous adventures held an enticing allure, masking their budget-blowing potential. Each impulse decision added up, turning my financial discipline into a distant memory. The post-vacation reality check was sobering. Fun has a price tag, and these unplanned expenses were a harsh reminder. Next time, I’ll curb my spontaneity with a budgetary leash.

8. Resort Fees That Disguised Themselves as Luxury

I booked a budget hotel, but at checkout I got slapped with $45/day in “resort fees.” For what? Towels and slow Wi-Fi? It was the sneakiest line on my receipt—and it added up fast. These hidden charges masked as luxury amenities were a rude awakening. While I expected a modest stay, I ended up paying for services I barely used. The supposed ‘extras’ felt like a deceptive money grab. As I tallied the costs, the fantasy of budget travel crumbled. My wallet was lighter, and my lesson was learned: always read the fine print.

9. Credit Card “Rewards” That Encouraged Overspending

I convinced myself I was earning points with every swipe. But by the time I got home, I had more stress than miles—and a balance that made me cringe. Dave would’ve said, “Cut the card.” The allure of rewards masked the spiraling debt. Each swipe felt rewarding, yet the mounting balance told a different story. The illusion of gain overshadowed the reality of financial strain. As I unpacked souvenirs, the cost of ‘rewards’ became painfully clear. I learned that genuine wealth lies in savings, not points. Next time, I’ll treasure restraint over rewards.