Your wallet holds more than just plastic—it carries hidden benefits that can rescue a ruined trip or save hundreds of dollars. Most travelers swipe their credit cards without realizing the powerful protections and perks lurking in the fine print. From emergency cash when flights go haywire to free lounge access and insurance that rivals standalone policies, these forgotten features can transform how you travel.

1. Trip Delay Reimbursement

Stuck overnight because of weather or mechanical problems? Your card might cover the hotel, meals, and essentials. Many travel cards reimburse reasonable expenses when flights are delayed beyond six to twelve hours, as long as you booked the trip—or even just the taxes on an award ticket—with that card.

The catch is documentation. Save every receipt from that airport pizza to the toothbrush you grabbed at the convenience store.

File your claim within the window your issuer specifies, usually thirty to sixty days. Attach boarding passes, delay confirmation from the airline, and a brief explanation. Most people never bother, leaving hundreds of dollars on the table after a miserable delay.

2. Trip Cancellation & Interruption Coverage

Life throws curveballs—sudden illness, family emergencies, or hurricanes can wreck even the best-laid plans. Select cards step in to reimburse non-refundable hotel nights, flights, and tours when covered events force you to cancel or cut a trip short. Coverage limits and eligible reasons vary wildly, so dig into your card’s Guide to Benefits before disaster strikes.

You’ll need proof: doctor’s notes for medical claims, death certificates for bereavements, or official weather advisories. Keep copies of every booking confirmation and charge receipt.

This perk can recover thousands, yet countless cardholders eat the loss because they assume travel insurance means buying a separate policy. Check what you already own first.

3. Baggage Delay & Lost Baggage Insurance

When your suitcase takes a detour and you’re stuck in yesterday’s outfit, certain cards hand you cash to buy essentials. After a qualifying delay—often six or twelve hours—you can purchase clothes, toiletries, and other necessities, then file for reimbursement. Some cards also cover lost or damaged bags up to stated limits, though electronics and jewelry usually don’t qualify.

The golden rule: buy only what you truly need and hoard those receipts. A reasonable wardrobe refresh is fine; a designer shopping spree will get denied.

Submit your claim with the airline’s baggage delay report and proof of purchase. It won’t replace your favorite sneakers, but it beats wearing the same socks for three days.

4. Rental Car Collision Damage Waiver—Often Primary

Rental-counter insurance can double your daily rate, but many premium cards include collision damage waiver that lets you skip it. A subset offers primary coverage, meaning the card pays first—before your personal auto policy even gets involved. That protects your own insurance from rate hikes.

Always confirm whether your card is primary or secondary, which countries are excluded, and which vehicle types qualify. Exotic cars and large vans often aren’t covered.

Decline the agency’s CDW at the counter, pay the full rental with your card, and tuck the agreement away. If something happens, you’ll file a claim with your issuer and provide photos, police reports, and repair estimates.

5. Global Entry & TSA PreCheck Application Credits

Standing barefoot in a snaking security line while PreCheck travelers breeze past is maddening. Dozens of cards now cover the application fee—every four to five years—for TSA PreCheck or Global Entry, making fast-track screening a no-brainer for anyone who flies more than twice a year.

Here’s the insider move: if you travel internationally even occasionally, apply for Global Entry instead. It costs the same, includes TSA PreCheck, and speeds you through customs on return.

Check your card benefits portal for the credit, complete the online application, schedule your interview, and pay with the enrolled card. The fee posts, then the credit follows within a billing cycle or two. Five years of shorter lines for zero out-of-pocket.

6. Airport Lounge Access—But Rules Keep Changing

Premium cards can unlock proprietary lounges or networks like Priority Pass, turning layovers into mini-retreats with free food, drinks, and Wi-Fi. But access policies have tightened—Delta’s Sky Club, for instance, capped visits for certain AmEx cardholders starting in 2024, and other airlines have followed suit.

Before you stroll up to the lounge desk, confirm your card’s current rules. Some require you to be flying that airline; others limit guests or charge per visit beyond a set number.

Download your network’s app to locate participating lounges and check real-time crowding. When access works, it’s a game-changer. When it doesn’t, you’re stuck at a gate with overpriced snacks.

7. No Foreign Transaction Fees

Every swipe abroad on a card that charges foreign transaction fees tacks on one to three percent. That “cheap” gelato in Rome or coffee in Tokyo quietly costs more when the fee hits your statement. Many travel cards waive this surcharge entirely, letting you spend overseas without the hidden tax.

Check your card’s fee schedule before you board. If you’re carrying a card that charges, leave it home and use the one that doesn’t.

Over a two-week trip, the savings add up fast—sometimes enough to cover a nice dinner or an extra museum ticket. It’s one of the simplest perks to capture, yet plenty of travelers still hand over three percent to their issuer for no reason.

8. Cell Phone Protection When You Pay Your Bill

Drop your phone in a fountain or have it stolen from a cafe table, and you’re facing a pricey replacement. A growing roster of cards includes coverage for theft or damage—up to a few hundred dollars per claim—if you pay your monthly cell bill with that card. Deductibles, per-claim caps, and the number of eligible lines vary by issuer.

Set up autopay with the right card and forget about it until disaster strikes. Then file a claim with proof of the bill payment, a police report for theft, or a repair estimate for damage.

It won’t cover every scenario—loss without theft is often excluded—but it beats paying full retail for a new device when accidents happen on the road.

9. Automatic Hotel Elite Status and Perks

Earning hotel elite status used to mean dozens of nights in cookie-cutter rooms. Some cards hand you entry-level or mid-tier status automatically, unlocking late checkout, room upgrades when inventory allows, bonus points on stays, and sometimes free breakfast. Benefits swing widely depending on the chain and the card’s partnership.

Don’t expect suite upgrades every visit—availability drives those perks—but late checkout alone can save a rushed morning or an awkward lobby wait. Bonus points stack up over time, too.

Link your card-provided status to your loyalty account as soon as it’s granted, and always book directly with the hotel to ensure perks apply. Third-party sites often strip away elite benefits, leaving you with nothing but a standard room.

10. Concierge & Travel-Lifestyle Services

Visa Signature, Visa Infinite, Mastercard World, and World Elite cards come with twenty-four-seven concierge and travel services that most cardholders never dial. Need a last-minute reservation at that impossible-to-book restaurant? Want help rebooking flights when plans implode? The concierge can assist with research, bookings, and problem-solving.

Results vary—don’t expect miracles for sold-out events—but when you’re juggling time zones or stuck in an unfamiliar city, having a human on the other end beats scrolling review sites at midnight.

Availability and scope depend on your card network and issuer, so test the service before you desperately need it. Store the number in your phone and treat it like a travel insurance policy you hope not to use.

11. Roadside Assistance Dispatch

Blow a tire on a desolate highway or drain your battery in an unfamiliar parking lot, and panic sets in fast. Some card networks include a pay-per-use roadside dispatch program—towing, jump starts, tire changes, lockout service—so you don’t have to scramble through search results for help. It’s not free, but rates are often flat and transparent.

Call the number on the back of your card, and the network connects you to a local provider. You pay on the spot or get billed later, depending on the program.

It’s especially handy on road trips where you’re far from your usual mechanic or AAA coverage area. Keep the hotline saved; you’ll feel like a genius when trouble strikes.

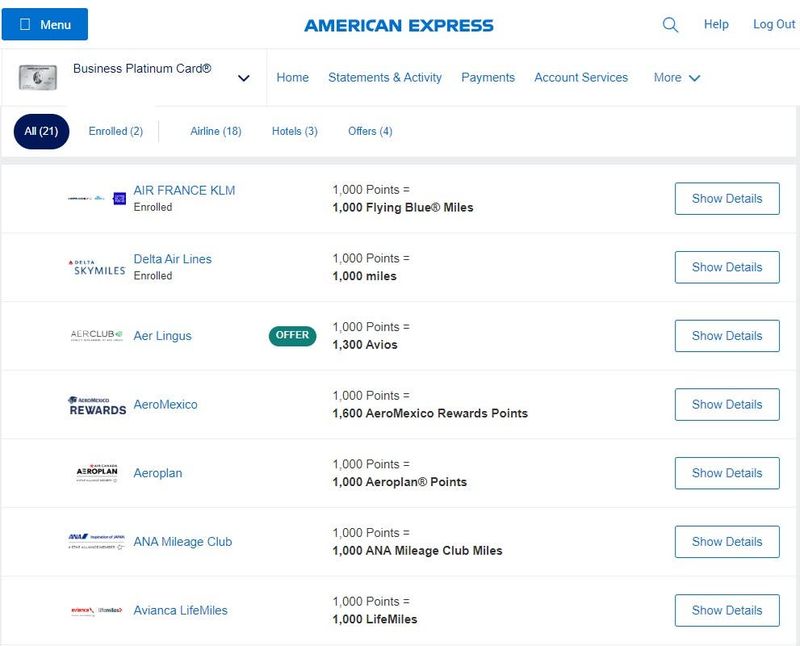

12. Transferable Points & Partner Sweet Spots—With a Caveat

Bank points that transfer to airline and hotel partners can unlock jaw-dropping value—think lie-flat business class for a fraction of the cash price—if you learn the partners and their award charts. Sweet spots exist where points stretch furthest, but values and availability shift. U.S. regulators recently warned issuers against devaluing points or making redemptions unreasonably difficult, yet changes still happen.

Before you transfer, confirm current award pricing and search for actual availability. Transfers are usually instant but sometimes irreversible, so don’t move points until you’ve found the flight or room you want.

Master a few key partners, watch for transfer bonuses, and you’ll fly better for less. Ignore the rules, and you’ll burn points on mediocre redemptions.