Travel credit cards can save you hundreds or even thousands of dollars on your next trip. Smart cardholders know these plastic rectangles offer way more than just rewards points. From sneaky ways to trigger insurance coverage to maximizing transfer bonuses, these proven strategies help you squeeze every drop of value from your cards.

1. Time Big Bills to Earn Welcome Bonuses

Smart spenders know timing is everything when chasing sign-up bonuses. Major expenses like tax payments can help you hit spending thresholds faster than waiting for regular purchases.

The IRS accepts credit card payments through third-party processors, though they charge fees around 1.75% to 1.85%. Before you swipe, calculate whether the welcome bonus value exceeds the processing fee.

For example, if you need to spend $4,000 for a 60,000-point bonus worth $600, paying a $70 fee on taxes makes financial sense. Always verify current processor fees before committing to this strategy.

2. Master Transferable Points with Airline Partners

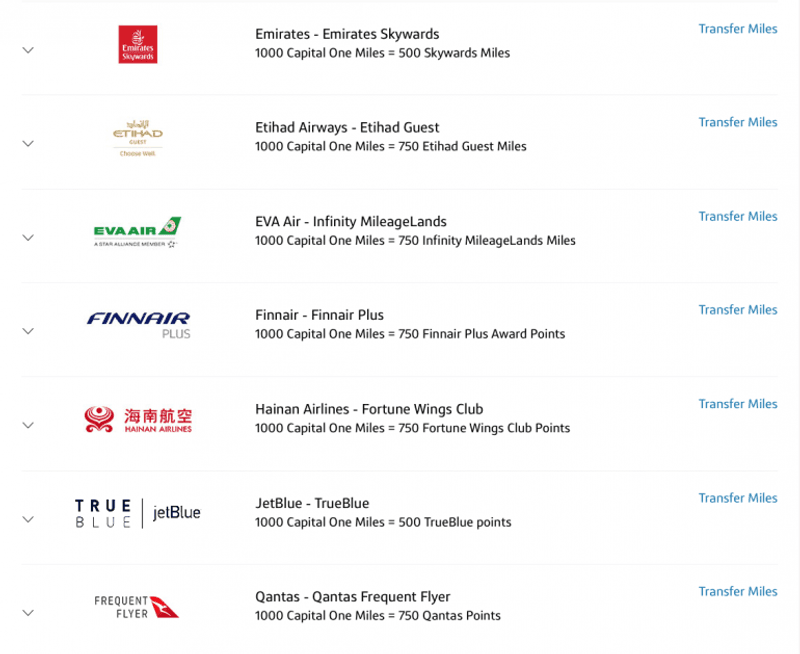

Flexible points programs like Chase Ultimate Rewards and Amex Membership Rewards unlock serious travel value through partner transfers. Instead of cashing out at fixed rates, these points often stretch further when moved to airline programs.

Check your card issuer’s transfer partner list regularly, as relationships and ratios change. Some transfers happen instantly while others take days, so plan accordingly for time-sensitive bookings.

A 50,000-point transfer to the right airline partner might score you a business class ticket worth $3,000, versus $500 in cash back. Research award charts before transferring to maximize your point value.

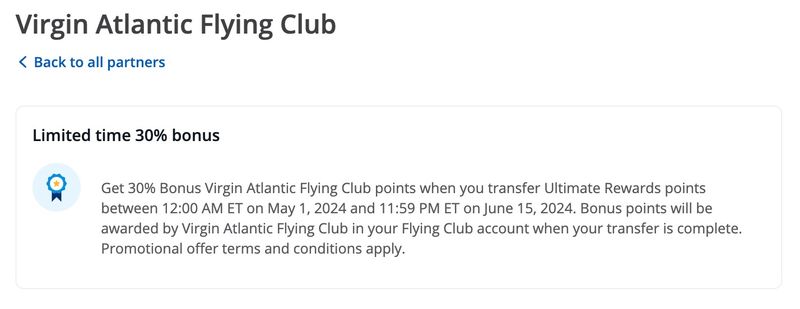

3. Hunt Down Limited-Time Transfer Bonuses

Transfer bonuses are like finding money in your couch cushions, except better. Credit card companies regularly offer 20% to 40% bonus miles when you transfer points to specific airline partners during promotional periods.

These limited-time offers can dramatically reduce the points needed for award tickets. A 40% bonus means your 50,000 points become 70,000 miles in the airline program.

Bookmark transfer bonus tracking websites and sign up for alerts from your card issuers. These promotions often last just weeks and can disappear without warning, so act quickly when valuable bonuses appear.

4. Book Through Travel Portals When Math Works

Card issuer travel portals sometimes offer sweet spots for earning or redeeming points. Many cards award bonus points for portal bookings, while others boost redemption values above standard rates.

Portal rates change frequently, so always compare current earning multipliers and redemption values before booking. What worked last year might not be the best deal today.

Some portals historically offered 1.25x to 1.5x point values for certain cards, but programs evolve constantly. Check your specific card’s current portal benefits and compare total costs against booking directly or through other channels before committing.

5. Trigger Trip Protection on Award Tickets

Here’s a sneaky trick most travelers miss: paying even small portions of award tickets with covered cards can activate trip protections. Those $50 in taxes and fees might unlock hundreds in delay coverage.

When flights get delayed beyond your card’s threshold (often 12+ hours or overnight), you could receive reimbursement for meals and hotels up to policy limits.

Read your card’s trip delay coverage carefully, as rules vary between issuers. Some require the entire trip cost on the card, while others activate protection with any portion paid. This small detail can save your vacation budget when weather strikes.

6. Skip Rental Car Insurance with Primary Coverage

Rental car counters push expensive collision damage waivers, but cards with primary coverage let you confidently decline these add-ons. Primary coverage means your card pays first, protecting your auto insurance rates.

Secondary coverage requires filing with your personal auto insurer first, potentially raising your rates. Primary coverage handles claims directly without involving your regular car insurance.

Always verify your card offers primary (not secondary) rental coverage and follow the rules exactly. Pay for the rental with the covered card and formally decline the agency’s insurance to activate protection. One mistake can void coverage entirely.

7. Eliminate Foreign Fees and Currency Tricks

Foreign transaction fees quietly drain 1% to 3% from every international purchase. Cards without foreign transaction fees instantly save money abroad, making them essential travel companions.

Payment terminals often offer to charge in US dollars instead of local currency through dynamic currency conversion. This convenience costs extra, as conversion rates are typically worse than your card network’s rates.

Always choose to pay in local currency and let your card network handle conversion. This simple choice can save 3% to 5% on every transaction during international trips, adding up to significant savings.

8. Stack Rewards Through Shopping Portals

Double-dipping rewards is perfectly legal and profitable when done right. Airline shopping portals and dining programs award bonus miles on top of your credit card’s regular earning rate.

Before making purchases, click through airline shopping portals or link your card to dining programs. You’ll earn portal bonuses plus regular card rewards on the same transaction.

Amex cardholders can even set Rakuten to pay out in Membership Rewards points instead of cash back. This stacking strategy works for online shopping, restaurant visits, and many everyday purchases, multiplying your earning potential without extra spending.

9. Use 24-Hour Rules for Flight Repricing

Department of Transportation rules give you breathing room after booking flights. Airlines must allow free cancellation within 24 hours of purchase for flights departing seven or more days later.

This rule applies to most US carriers and foreign airlines selling tickets in America. Some airlines offer fare holds instead of free cancellation, giving you 24 hours to decide without payment.

Use this window to fix booking mistakes, add companions, or rebook if prices drop. The 24-hour rule has saved countless travelers from expensive change fees and booking regrets, making it one of the most valuable consumer protections.

10. Get Expedited Security Programs Reimbursed

TSA PreCheck and Global Entry fees disappear when your travel card picks up the tab. Many cards automatically reimburse application fees when you pay with the covered card.

PreCheck costs vary by enrollment provider, while Global Entry runs $120 for five years of expedited airport and border processing. The time savings alone justify these programs for frequent travelers.

Check your card’s benefits page for automatic statement credit procedures. Some cards require enrollment through specific links, while others reimburse any qualifying charge. These programs pay for themselves quickly through reduced airport stress and shorter lines.

11. Pool Household Points for Bigger Rewards

Family teamwork amplifies credit card rewards when programs allow point pooling. Household members can often combine points to reach award thresholds faster or book from the account with the best redemption rates.

Chase Ultimate Rewards allows household point transfers between certain cards, while other programs have different rules and restrictions. Always follow each issuer’s specific guidelines to avoid account penalties.

Pooling works especially well for expensive awards like international business class tickets. Instead of waiting years to accumulate enough points individually, families can combine resources and take turns enjoying premium redemptions together.