Fast food chains across America are facing unprecedented challenges in 2025. Rising costs, changing consumer habits, and economic pressures have pushed many beloved restaurants to the brink.

Some brands that once dominated neighborhoods are now filing for bankruptcy or shutting down locations at alarming rates. Here are 21 fast food chains fighting to stay alive this year.

1. Subway

Once the world’s largest sandwich chain, Subway continues shutting down stores nationwide at a concerning pace. Franchise instability has created a domino effect of closures.

Legal issues plague the brand while owners struggle with declining profits and rising operational costs. Many franchisees can no longer afford rent or staff wages.

Store closures have accelerated dramatically, leaving former locations empty across suburban strip malls and urban centers nationwide.

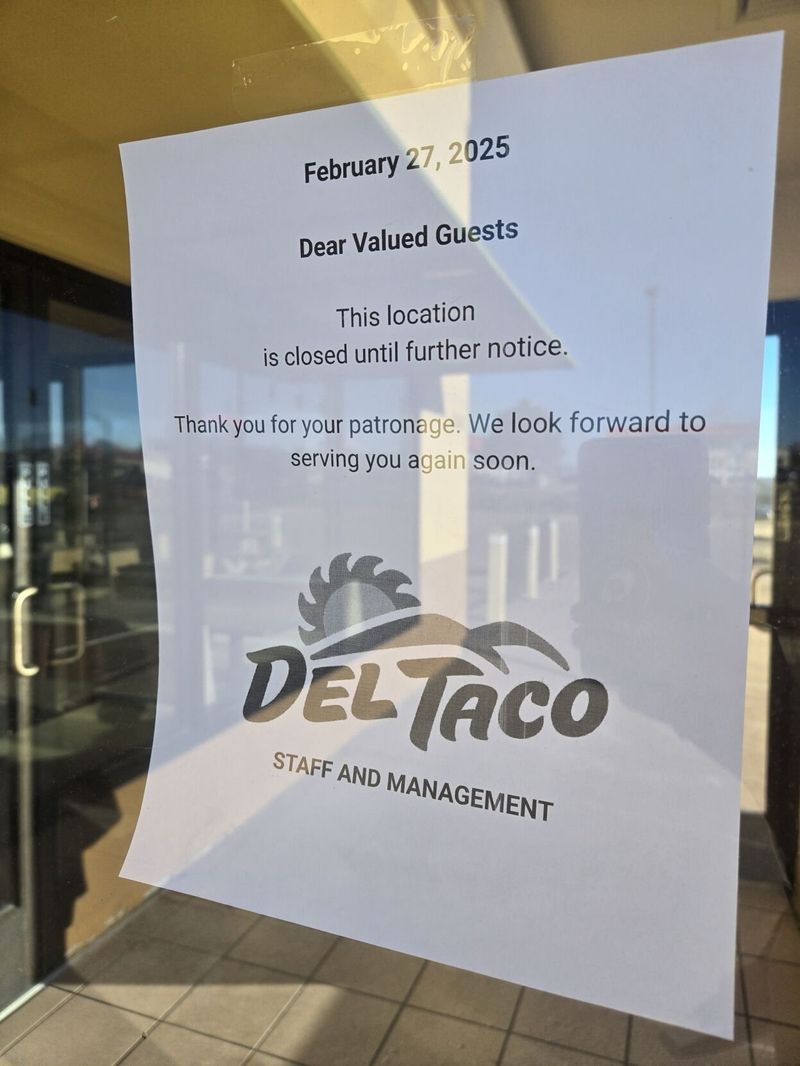

2. Del Taco

Del Taco’s financial troubles hit hard when major franchisee Matador filed for Chapter 11 bankruptcy protection earlier this year. Seventeen locations closed recently as a direct result.

The Mexican-American fast food chain has struggled to compete against larger rivals like Taco Bell and Chipotle. Rising ingredient costs have squeezed already thin profit margins.

Remaining locations face uncertainty while corporate headquarters works to restructure debt and find new franchise partners willing to invest.

3. Jack in the Box

Management announced plans to close between 150 and 200 locations amid declining performance across multiple markets. Same-store sales have dropped significantly over recent quarters.

The West Coast burger chain faces intense competition from newer fast-casual concepts. Many locations struggle with outdated equipment and aging building infrastructure.

Corporate executives are focusing resources on profitable markets while abandoning underperforming regions entirely to cut losses and preserve remaining operations.

4. McDonald’s Select Locations

Even McDonald’s isn’t immune to current market pressures, experiencing its steepest sales drop since 2020 in certain U.S. markets. Corporate restructuring is underway nationwide.

Select locations face closure as the golden arches giant optimizes its footprint. Rising labor costs and supply chain disruptions continue impacting profitability.

While the brand remains globally strong, specific regional markets show concerning weakness requiring immediate intervention and strategic repositioning efforts.

5. Wendy’s

Customer traffic is down significantly while sales remain disappointingly soft across numerous markets. Ongoing closures reflect the brand’s struggle to maintain relevance.

The square burger chain faces pressure from both premium fast-casual options and value-oriented competitors. Marketing efforts haven’t translated into sustained foot traffic increases.

Franchise operators report difficulty covering basic operational expenses, leading to voluntary store closures rather than continued losses in challenging markets.

6. Burger King

Several franchise groups have filed Chapter 11 bankruptcy, forcing the closure of underperforming stores across multiple states. Financial restructuring continues throughout the system.

The home of the Whopper struggles with brand identity while competing against McDonald’s and newer burger concepts. Many locations require expensive renovations.

Corporate leadership focuses on supporting viable franchisees while allowing weak operators to exit the system through controlled bankruptcy proceedings and asset sales.

7. KFC

Locations have been shuttered in various states as the fried chicken giant struggles to maintain market share against rising competitors like Popeyes and Chick-fil-A.

Supply chain issues have affected chicken quality and availability. Many franchise operators face mounting debt from decreased sales and increased operational costs.

The Colonel’s legacy brand works to revitalize its image while closing unprofitable locations and investing resources in stronger markets with better growth potential.

8. Church’s Chicken

Church’s Chicken continues losing ground to competitors while multiple locations have closed permanently. The Louisiana-style fried chicken chain faces intense market pressure.

Customer preferences have shifted toward perceived higher-quality options. Many Church’s locations operate in economically challenged areas where spending has decreased significantly.

Franchise owners struggle with rising costs while maintaining competitive pricing, creating unsustainable business conditions that force difficult closure decisions across affected markets.

9. Hooters

The wing chain filed Chapter 11 bankruptcy in April 2025, subsequently closing over 30 locations nationwide. Changing social attitudes have impacted the brand’s appeal.

Rising operational costs combined with declining customer traffic created unsustainable financial conditions. Many locations struggled with outdated concepts and expensive lease agreements.

Management attempts to restructure debt while repositioning the brand for modern consumers, though success remains uncertain given current market challenges and cultural shifts.

10. On The Border

The Tex-Mex chain filed for bankruptcy protection and closed over 40 outlets as consumer preferences shifted toward authentic Mexican cuisine and fast-casual concepts.

Rising ingredient costs particularly impacted Mexican restaurant operations. Many locations couldn’t adapt quickly enough to changing dining habits and delivery demands.

Remaining restaurants face uncertain futures while corporate leadership navigates bankruptcy proceedings and attempts to identify viable markets for continued operations going forward.

11. TGI Fridays

TGI Fridays filed Chapter 11 bankruptcy with over 30 U.S. locations closing since late 2024. The casual dining chain couldn’t recover from pandemic-related losses.

Happy hour culture declined significantly while younger consumers gravitated toward different dining experiences. High lease costs became unsustainable with reduced customer traffic.

Corporate restructuring aims to preserve viable locations while eliminating underperforming restaurants that drain resources from potentially profitable operations in better markets.

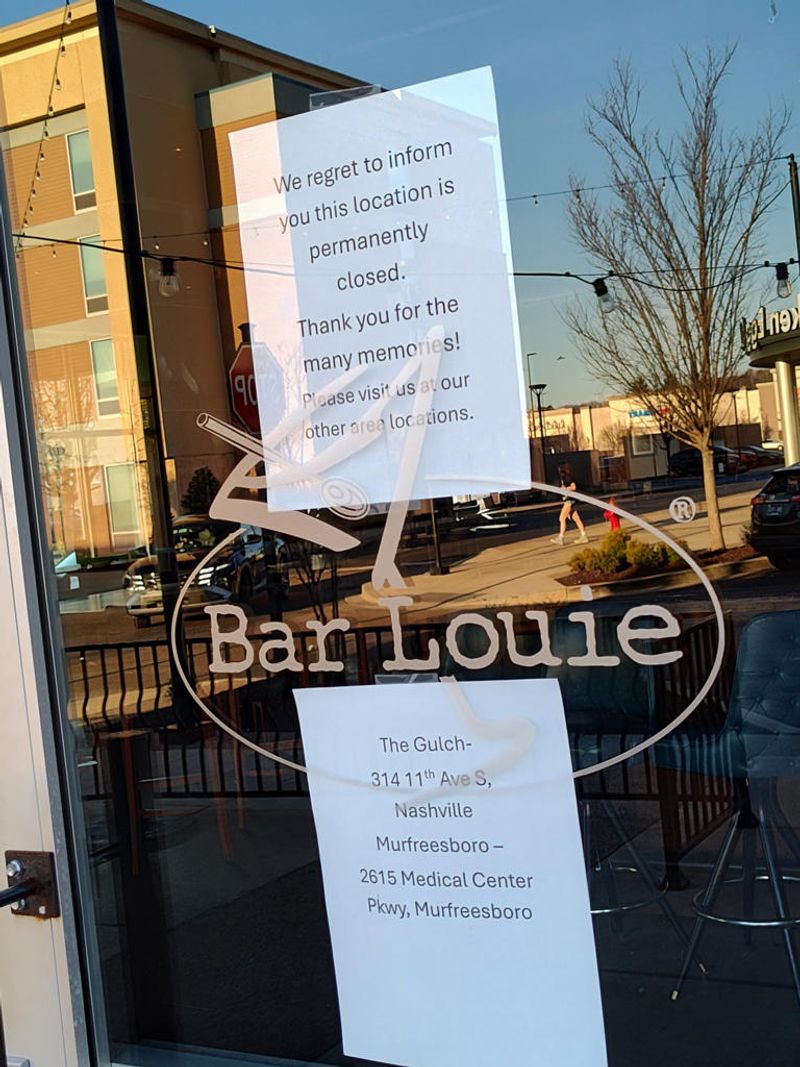

12. Bar Louie

Bar Louie filed Chapter 11 bankruptcy in March 2025, leading to 13 location shutdowns across multiple markets. The bar and grill concept struggled post-pandemic.

Alcohol sales declined while food service couldn’t compensate for lost beverage revenue. Many locations operated in expensive urban markets with high overhead costs.

Remaining locations attempt to restructure operations while management seeks buyers or partners willing to invest in the troubled brand’s future development and growth.

13. Quiznos

Once boasting over 4,700 stores nationwide, Quiznos now operates fewer than 150 remaining locations. The toasted sub chain’s dramatic decline continues accelerating.

Aggressive franchise expansion followed by corporate mismanagement devastated the brand. Many former locations converted to competing sandwich chains or closed permanently.

Surviving restaurants operate independently with minimal corporate support, relying on local customer loyalty while facing continued pressure from Subway and other competitors.

14. Sizzler USA

Post-restructuring struggles continue plaguing Sizzler USA, with only approximately 80 stores remaining from its once-mighty steakhouse empire. Recovery efforts show mixed results.

The all-you-can-eat salad bar concept lost appeal during health-conscious dining trends. Many locations couldn’t justify expensive lease agreements with declining customer traffic.

Remaining restaurants focus on core steak offerings while eliminating unprofitable menu items and services that previously defined the Sizzler dining experience nationwide.

15. Ground Round

Fewer than five Ground Round locations remain operational, marking the slow demise of what was once a popular family restaurant chain across America.

The sports bar and grill concept couldn’t compete with newer casual dining options. Rising operational costs made small-scale operations financially unsustainable for remaining owners.

Surviving locations operate as independent restaurants while maintaining minimal brand identity, essentially functioning as local establishments rather than national chain participants.

16. Eegee’s

Arizona-based Eegee’s filed for bankruptcy protection and closed five locations, threatening the beloved regional chain known for frozen drinks and submarine sandwiches.

Local competition intensified while expansion costs exceeded revenue growth. The regional brand struggled to maintain quality while managing financial obligations and operational expenses.

Remaining Arizona locations hope to survive bankruptcy proceedings while loyal customers rally to support their favorite local chain through difficult financial restructuring efforts.

17. Sonic Drive-In

Sporadic closures have been reported in multiple cities as individual Sonic Drive-In locations struggle with operational challenges and declining profitability across various markets.

The drive-in concept faces pressure from modern fast food delivery services. Many locations require expensive equipment updates and facility maintenance investments.

While corporate Sonic remains stable, individual franchise operators face difficult decisions about continued operations versus closure when facing mounting financial pressures and losses.

18. Bertucci’s

Bertucci’s filed its third Chapter 11 bankruptcy in April 2025, resulting in multiple New England closures. The Italian restaurant chain continues struggling with financial stability.

Repeated bankruptcy filings indicate systemic operational problems beyond temporary market conditions. High lease costs in New England markets compound ongoing profitability challenges.

Remaining locations operate under uncertainty while management attempts another restructuring effort, though previous bankruptcy experiences suggest limited long-term viability prospects for the brand.

19. Red Lobster

Red Lobster filed Chapter 11 bankruptcy in 2024, closing nearly 100 locations in under a year. The seafood chain’s financial troubles shocked many industry observers.

Expensive lease agreements and declining casual dining traffic created unsustainable operating conditions. The endless shrimp promotion reportedly contributed to significant financial losses.

Surviving restaurants attempt to restructure while maintaining seafood quality standards that customers expect, though future expansion seems unlikely given current market conditions and constraints.

20. Boston Market

Boston Market collapsed dramatically from over 300 stores to under 20 locations, facing legal issues, financial problems, and widespread lease defaults nationwide.

Unpaid vendor bills and employee wages created legal liabilities while lease violations resulted in evictions. The rotisserie chicken chain couldn’t maintain basic operational requirements.

Few remaining locations operate independently with minimal corporate oversight, essentially functioning as local restaurants using Boston Market branding without central support or standardized operations.

21. Frisch’s Big Boy

Evictions and closures due to unpaid rent continue shrinking the Frisch’s Big Boy brand rapidly across Ohio and surrounding states. Financial troubles mount daily.

The classic American diner chain couldn’t adapt to modern fast food competition while maintaining expensive full-service restaurant operations and overhead costs.

Remaining locations face uncertain futures as corporate leadership struggles with mounting debt, lease obligations, and operational expenses that exceed revenue from declining customer traffic.