The restaurant industry is facing a major shake-up as we head into 2025. Many beloved fast food and casual dining spots are shutting their doors across the country due to rising costs, changing customer habits, and tough competition. From sandwich shops to burger joints, these chains are downsizing in ways that might affect your favorite local spots.

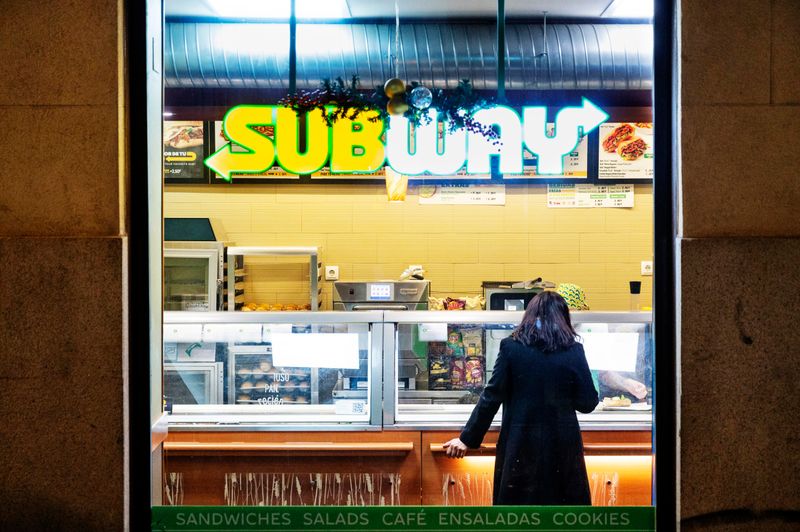

1. Subway’s Massive Footprint Shrinking

America’s sandwich giant continues its dramatic downsizing with approximately 600 more U.S. locations vanishing from street corners and strip malls. The chain’s once-impressive 27,000+ location count has dwindled to just 19,502 shops—its lowest point in two decades.

Financial struggles and franchise disputes have plagued the company for years. Since 2022, more than 1,600 Subway restaurants have permanently closed their doors, reflecting broader challenges in the quick-service industry.

Despite these closures, Subway remains committed to revitalizing its brand through menu innovations and store redesigns. The chain hopes these efforts will strengthen remaining locations even as its total footprint continues to contract significantly.

2. Jack in the Box Scaling Back Operations

The iconic smiling clown mascot won’t be grinning at as many locations in 2025. Jack in the Box plans to shutter between 150-200 restaurants nationwide, representing roughly 10% of its entire operation.

Executives confirmed that 80-120 locations will close by year’s end, with the remainder following shortly after. The company cites underperformance and shifting consumer preferences as primary reasons behind this significant reduction.

Most closures target older, less profitable locations that haven’t kept pace with evolving customer expectations. Jack in the Box hopes this strategic trimming will allow them to focus resources on renovating remaining stores and expanding in more promising markets where their tacos and burgers still maintain strong appeal.

3. Red Robin Flies Away From Underperforming Nests

Famous for bottomless fries and gourmet burgers, Red Robin plans to close up to 15 struggling locations across the United States in 2025. Company representatives indicate more closures may follow depending on performance metrics and lease negotiations with property owners.

The casual burger chain has struggled to maintain profitability amid rising food costs and changing dining habits. Young families—once Red Robin’s core demographic—increasingly opt for faster, less expensive dining options or meal delivery services.

Remaining locations will receive much-needed updates, including streamlined menus and enhanced technology for faster service. Red Robin hopes these changes will strengthen its position in the competitive casual dining landscape where many established chains continue to struggle against newer concepts.

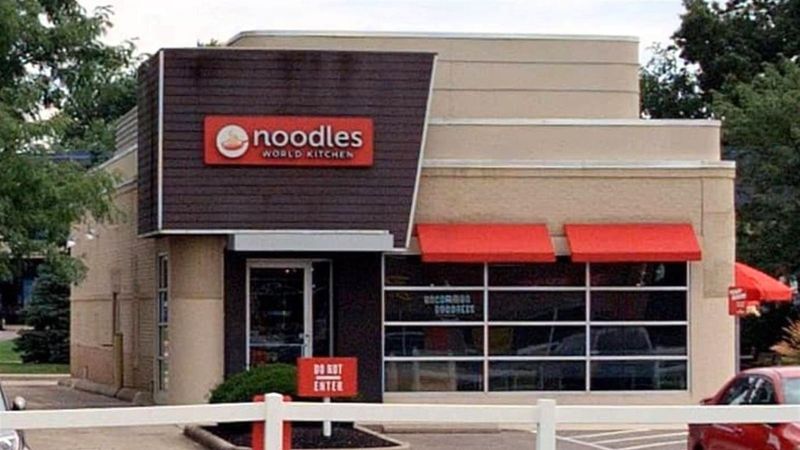

4. Noodles & Company Trims Its Pasta Portfolio

Carb lovers will have fewer places to twirl their forks as Noodles & Company prepares to close approximately 20 locations by mid-2025. The fast-casual pasta chain has struggled to maintain consistent growth despite menu innovations and marketing efforts.

Rising ingredient costs have squeezed profit margins on their signature dishes. Leadership hopes this strategic reduction will create a leaner, more profitable company focused on high-performing markets where their noodle bowls remain popular.

Most closures target standalone locations with high operational costs rather than those in shopping centers or food courts. Noodles & Company plans to redirect resources toward expanding their digital ordering capabilities and developing smaller-footprint restaurant designs that require less square footage and fewer staff members.

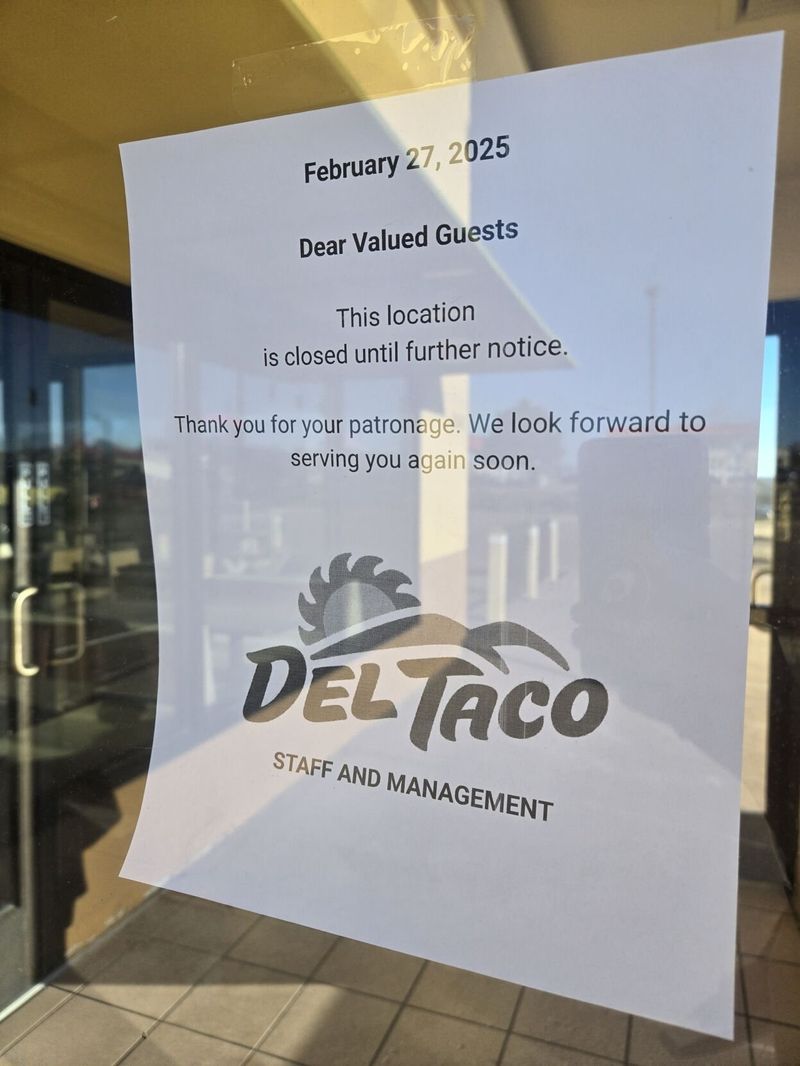

5. Del Taco’s Colorado Collapse

Mexican fast-food favorite Del Taco has permanently shuttered 18 locations across Colorado following a major franchisee bankruptcy. The sudden closures left hundreds of workers unemployed and loyal customers without their fix of fresh-prepped tacos and burritos.

Equipment from these locations has already been auctioned off, suggesting no plans for reopening under new ownership. Industry analysts suggest the regional collapse may signal broader troubles for the brand, which competes directly with Taco Bell and smaller regional chains.

Corporate representatives remain tight-lipped about whether more closures might follow in other markets. The company continues to evaluate its nationwide footprint as part of ongoing restructuring efforts aimed at strengthening the brand against fierce competition in the Mexican fast-food segment.

6. Dairy Queen’s Texas Meltdown

The home of the Blizzard faces a freeze-out in Texas where a major franchisee has closed at least 25 locations. Auction notices for restaurant equipment appeared practically overnight, shocking loyal customers who had frequented these spots for decades.

While these closures appear isolated to one franchisee’s financial troubles rather than a brand-wide issue, they represent a significant loss in a state where DQ has traditionally maintained a strong presence. Local news reports indicate the shuttered locations were primarily in smaller communities where they had served as popular gathering spots.

Dairy Queen corporate maintains that other locations throughout Texas and nationwide remain strong. Nevertheless, the sudden closures highlight the financial pressures facing even established brands in today’s challenging fast-food landscape.

7. Boston Market’s Continued Collapse

Once-beloved for its rotisserie chicken and homestyle sides, Boston Market continues its dramatic decline with over 50 more locations closing in 2025. Legal troubles and financial instability have plagued the chain for years, with bankruptcy filings further complicating its future.

Many locations closed with little or no notice to employees or customers. Some workers reported arriving for shifts only to find doors locked and closure notices posted, highlighting the chaotic nature of the company’s contraction.

From its peak of over 1,100 restaurants nationwide, Boston Market has shrunk to fewer than 300 locations. Industry experts question whether the brand can survive long-term given its ongoing struggles to compete with both traditional fast food and newer fast-casual concepts offering similar comfort food options.

8. Steak ‘n Shake’s Dramatic Downsizing

The iconic burger and milkshake chain continues its years-long contraction with dozens more locations shutting down in 2025. Since 2018, approximately 200 Steak ‘n Shake restaurants have disappeared from American roadsides, with no signs of slowing.

Many remaining locations have transitioned from full-service dining to counter-service models with digital kiosks replacing traditional servers. This dramatic shift aims to reduce labor costs while maintaining the brand’s signature steakburgers and hand-dipped shakes that customers have enjoyed since 1934.

The company increasingly focuses on franchise partnerships rather than corporate-owned locations. This strategy allows Steak ‘n Shake to maintain brand presence while shifting operational costs and risks to individual franchisees who must implement the new kiosk-centered business model.

9. Quiznos’ Toasted Farewell

Remember when Quiznos dominated the toasted sub sandwich market? Their continued decline hits another milestone in 2025 as more locations permanently close their doors. The once-mighty chain that boasted over 5,000 locations now operates fewer than 200 restaurants nationwide.

Competition from Subway and newer sandwich concepts has steadily eroded Quiznos’ market share. Failed marketing strategies and franchisee disputes accelerated their downfall, leaving many loyal customers without access to their signature toasted subs.

Remaining locations struggle to maintain relevance in the crowded sandwich marketplace. Industry analysts question whether Quiznos can survive as a national brand or if it will eventually disappear entirely, joining other food chains that couldn’t adapt to changing consumer preferences and competitive pressures.

10. Sbarro’s Mall Exodus Accelerates

The pizza-by-the-slice mall staple continues its retreat as shopping centers nationwide struggle with declining foot traffic. More than 150 Sbarro locations will disappear in 2025, primarily from food courts that once reliably delivered hungry shoppers.

Bankruptcy proceedings have complicated the company’s operations for years. As malls transform or close entirely, Sbarro has failed to establish a strong presence in standalone locations that could compensate for lost mall-based revenue.

The chain’s business model—designed specifically for high-volume foot traffic in enclosed shopping centers—hasn’t translated well to other environments. While some locations have attempted to pivot toward delivery and online ordering, these efforts haven’t sufficiently offset losses from their traditional mall-based operations.

11. Hooters’ Wings Clipped by Bankruptcy

The controversial restaurant chain known for its wings and scantily-clad servers has declared bankruptcy and closed over 30 U.S. locations in early 2025. Changing social attitudes and increased competition in the wing restaurant category have steadily eroded Hooters’ once-dominant position.

Newer concepts like Twin Peaks and Wing House have captured market share while Hooters struggled to update its dated image. Many younger diners have shown less interest in the chain’s intentionally provocative atmosphere that once defined its brand identity.

Remaining locations face uncertain futures as the company navigates bankruptcy proceedings. Some franchisees have already begun exploring rebranding options that would maintain the sports bar and wing concept while moving away from the controversial uniform policies that have defined Hooters since its founding in 1983.

12. On The Border’s Bankruptcy Border Crossing

The Tex-Mex casual dining chain has filed for Chapter 11 protection and plans to close approximately 70 locations nationwide. Financial troubles had been brewing long before the official bankruptcy announcement, with declining sales and increased competition from both local Mexican restaurants and newer fast-casual concepts.

Many locations closed abruptly, leaving employees scrambling for new positions. The chain’s sizzling fajitas and margaritas weren’t enough to overcome operational inefficiencies and changing consumer preferences that increasingly favor delivery-friendly options.

Restructuring efforts will focus on maintaining profitable locations while shedding underperforming restaurants. Management hopes a leaner operation will allow the brand to eventually regain stability, though industry analysts remain skeptical about On The Border’s long-term prospects in the crowded casual dining marketplace.

13. Red Lobster’s Seafood Surrender

The iconic seafood chain famous for its endless shrimp promotions and cheddar bay biscuits is closing more than 120 locations in 2025. Financial pressures, including rising seafood costs and labor expenses, have made many locations unprofitable despite strong brand recognition.

Many closures target older, larger restaurants with excessive square footage and outdated decor. The company’s private equity owners have struggled to revitalize the brand that once dominated the casual seafood dining category but now faces competition from both higher-end seafood restaurants and cheaper fast-casual options.

Remaining locations will receive updated menus and interior renovations aimed at attracting younger diners. The chain hopes to balance its traditional appeal with more contemporary offerings, though recovery remains uncertain in a dining landscape that increasingly favors unique concepts over familiar chains.

14. TGI Fridays’ Massive Retreat

The casual dining pioneer known for its red-and-white striped awnings is saying goodbye to nearly 40% of its U.S. locations. Once the epitome of American casual dining, TGI Fridays has struggled to maintain relevance with younger consumers who favor more distinctive dining experiences.

Many closures affect aging locations with outdated interiors and high operational costs. The company hopes this dramatic downsizing will create a more sustainable business focused on modernized restaurants in high-traffic areas rather than suburban outposts that have seen declining patronage.

Remaining locations will receive significant updates, including streamlined menus and contemporary designs. TGI Fridays executives believe these changes will help the brand recapture some of its former appeal, though they face an uphill battle in a restaurant landscape that has evolved dramatically since the chain’s 1960s heyday.

15. Applebee’s Neighborhood Exits

The “neighborhood grill and bar” concept is becoming less neighborly as parent company Dine Brands plans to close dozens of underperforming Applebee’s locations by year-end. Many targeted restaurants occupy older buildings in suburban areas where competition from newer dining concepts has steadily eroded customer traffic.

Surprisingly, the chain plans to pivot toward urban areas with new fast-casual formats. This strategy represents a significant departure from Applebee’s traditional suburban focus that defined the brand for decades.

Remaining full-service locations will receive updated interiors and revised menus focused on simplified operations. The company hopes these changes will help Applebee’s better compete in a casual dining segment where many established chains continue to struggle against changing consumer preferences and rising operational costs.

16. Pizza Hut’s Dining Room Disappearing Act

Remember those distinctive red-roofed Pizza Hut restaurants where families gathered around plastic cups of soda and hot pizzas? Hundreds more of these nostalgic dine-in locations will permanently close in 2025 as the company continues its transition toward delivery and carryout-focused operations.

Most closures target older sit-down restaurants with their signature sloped red roofs and spacious dining rooms. These larger-format buildings have become increasingly expensive to maintain and staff compared to smaller delivery-focused locations.

The strategy reflects changing consumer preferences that favor convenience over dine-in experiences. While many will mourn the loss of these childhood pizza parlors, Pizza Hut believes streamlining operations around delivery and carryout will better position the brand to compete against Domino’s and other delivery-focused pizza chains.

17. Cracker Barrel’s Country Road Detour

The Southern-themed restaurant and gift shop combo known for rocking chairs on its front porches is closing multiple locations in slower-growth areas. Changing travel patterns and demographic shifts have reduced customer traffic at many rural and highway-adjacent Cracker Barrel restaurants that once thrived on road-trip visitors.

Company executives remain tight-lipped about exact closure counts and timing. However, industry analysts suggest the chain’s distinctive country-store concept has struggled to attract younger diners who often prefer more modern dining environments.

Remaining locations will receive subtle updates while maintaining the nostalgic country store aesthetic that defines the brand. Cracker Barrel hopes these refinements will help the chain maintain its appeal with loyal customers while potentially attracting new patrons seeking comfort food and Americana-themed dining experiences.

18. Denny’s Grand Slam of Closures

America’s 24-hour diner chain plans to permanently close approximately 150 locations in 2025, representing about 10% of its total restaurant count. Many targeted locations operate in areas with declining late-night traffic or increased competition from newer breakfast-focused concepts.

The chain famous for Grand Slam breakfasts has struggled to maintain relevance with younger consumers. Despite menu innovations and interior updates at some locations, many Denny’s restaurants maintain a dated appearance that has become less appealing in today’s competitive dining landscape.

Remaining locations will receive modernization efforts focused on updated interiors and streamlined operations. Denny’s hopes these changes will help the brand recapture some of its former appeal while maintaining its position as America’s accessible all-day, everyday diner concept.