Traveling abroad used to mean juggling foreign cash and dealing with expensive currency exchanges. Now, digital currency wallets offer a simpler way to manage money while exploring the world. These tools let you access funds, make payments, and convert currencies without carrying loads of cash. Whether you’re a digital nomad or occasional tourist, these twelve options will make your financial life easier on the road.

Hardware Wallets with Mobile Interfaces

Fort Knox in your pocket! Hardware wallets like Trezor and Ledger store your crypto offline, making them nearly impossible to hack. Connect them to mobile apps when you need to transfer small amounts to “hot wallets” for daily spending.

Think of it like keeping your savings in a vault while carrying just enough cash for coffee and souvenirs. Perfect for digital nomads who want bank-level security while bouncing between Bangkok and Berlin.

BlueWallet & Muun Mobile Apps

Ready to buy street food with Bitcoin? BlueWallet and Muun make spending crypto as easy as using Venmo. These smartphone apps function as your everyday spending wallets while exploring foreign lands.

No need to visit currency exchanges when you can pay directly in crypto. The interface is clean enough for beginners, yet powerful enough for crypto veterans who understand lightning networks and transaction fees.

Crypto.com & Coinbase Cards

Magic money cards! These crypto debit cards convert your digital coins to local currency instantly at the point of sale. Swipe your Crypto.com or Coinbase card at restaurants, hotels, or shops anywhere that accepts Visa or Mastercard.

Many offer sweet perks like cashback in crypto and zero foreign transaction fees. Some travelers even fund their entire journey through card rewards, turning everyday purchases into tiny investments.

AstroPay Multicurrency Wallet

Currency juggling made simple! AstroPay shines for budget travelers needing to handle multiple currencies without getting hammered by conversion fees. Load it up with funds before departure and spend through virtual or physical cards.

Particularly useful in regions where traditional banking gets tricky. The app’s straightforward design won’t overwhelm you with complicated features when you’re just trying to pay for your hostel.

PayPal’s Global Payment System

The veteran of digital payments still rocks for international travelers! PayPal’s strength lies in its universal acceptance and multi-currency support across more than 200 countries.

Send money to new friends you meet abroad or split bills without awkward cash exchanges. The buyer protection features provide peace of mind when booking tours from small operators in unfamiliar places.

Fun fact: PayPal processes over $1 trillion in payments annually across borders!

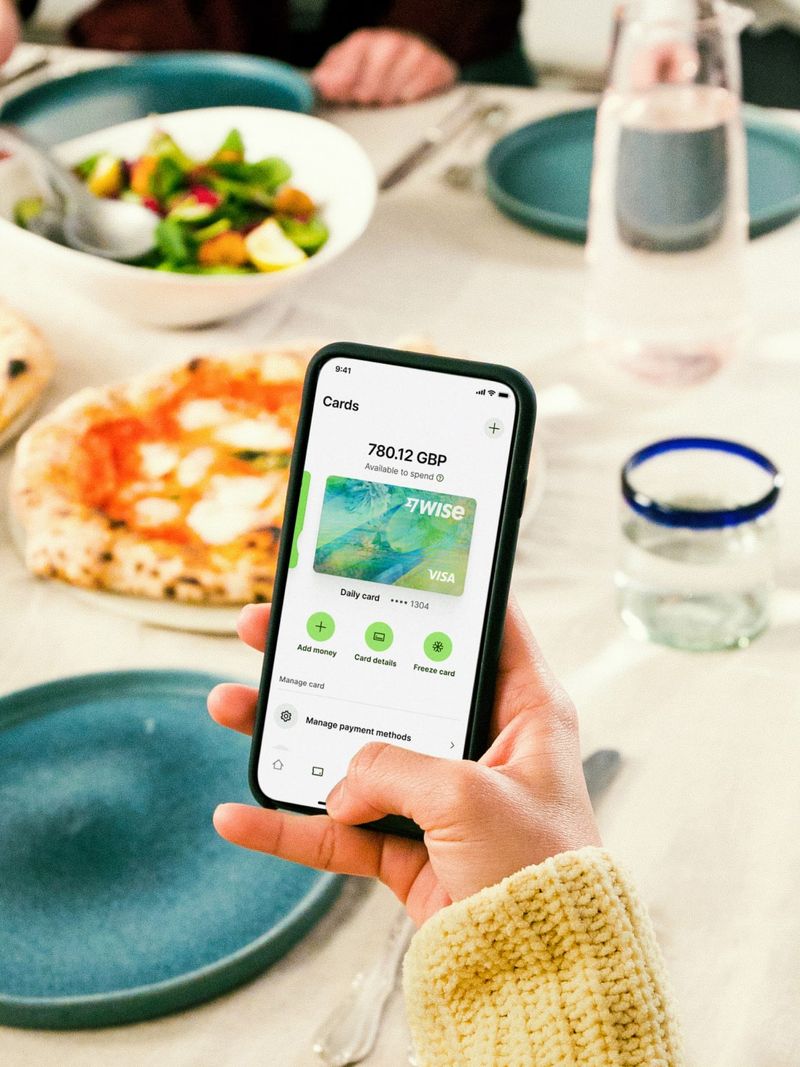

Apple Wallet with Wise Integration

Tap-and-go simplicity meets killer exchange rates! When you connect a Wise multi-currency card to Apple Wallet, you create a powerhouse travel tool that works seamlessly across continents.

No more fumbling with unfamiliar bills while locals wait impatiently behind you. Just tap your phone or watch to pay for subway tickets, museum entries, or late-night tacos.

The combo delivers exchange rates typically 2-3% better than traditional banks offer.

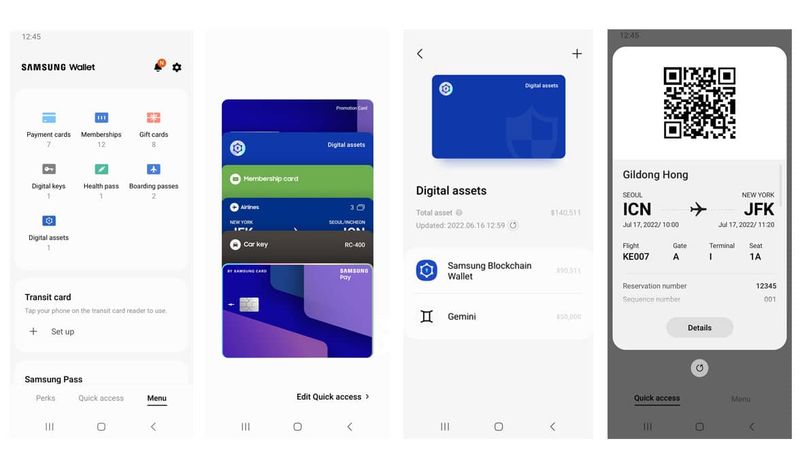

Samsung Wallet’s All-in-One Solution

Your entire travel wallet digitized! Samsung users rejoice—this app stores payment cards, boarding passes, loyalty programs, and even digital keys for hotel rooms.

The built-in security features use Samsung Knox protection to keep everything safe even on public WiFi. Particularly handy in tech-forward destinations like South Korea, Singapore, and Scandinavian countries where contactless payments rule.

The digital transit card feature works with systems in major cities worldwide.

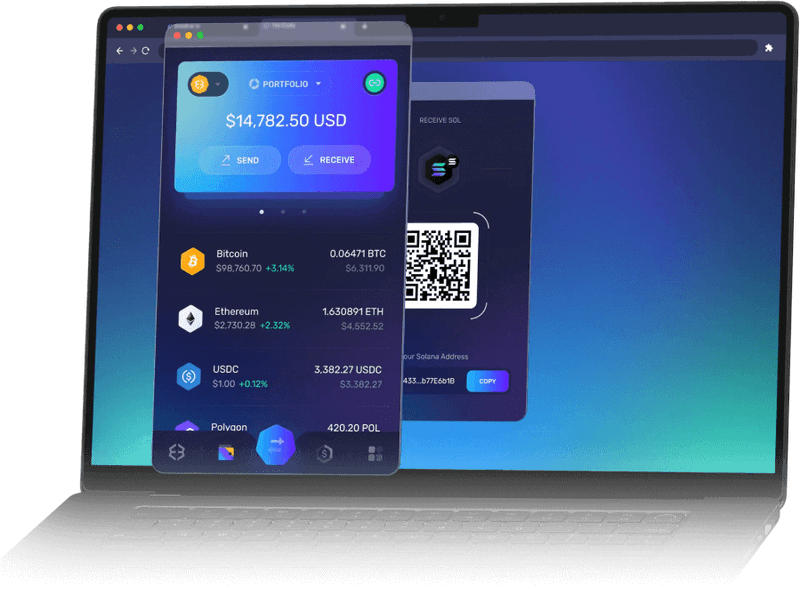

Exodus Wallet’s Cross-Platform Flexibility

Gorgeous design meets serious security! Exodus stands out with its beautiful interface that doesn’t sacrifice functionality. Available on desktop, mobile, and as a browser extension, it keeps your crypto accessible however you prefer to manage it.

The built-in exchange lets you swap between cryptocurrencies without leaving the app. When paired with a Trezor hardware device, it creates an unbeatable combination of convenience and protection.

Over 150 cryptocurrencies supported!

Skrill’s Border-Crossing E-Wallet

Veteran globetrotters swear by Skrill! This digital wallet supports 40+ currencies and works in over 100 countries, making it perfect for extended international adventures.

The prepaid Mastercard linked to your account provides ATM access worldwide. Especially valuable in regions where direct crypto payments aren’t widely accepted yet.

Merchants in tourist areas often prefer Skrill because it processes transactions quickly with lower fees than credit card networks.

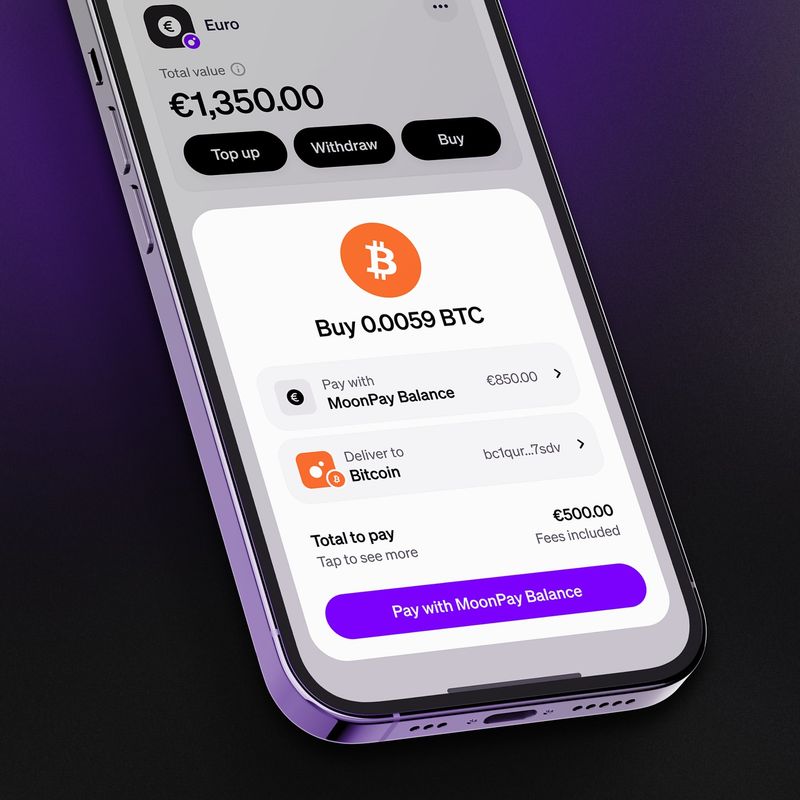

MoonPay’s On-the-Go Crypto Acquisition

Need crypto while traveling? MoonPay solves the “how do I get more Bitcoin in Bangkok?” problem. This service lets you buy cryptocurrency using credit cards, bank transfers, or mobile payment methods regardless of where you’re exploring.

The platform integrates directly with many popular wallets. No need to set up accounts on local exchanges or deal with unfamiliar banking systems when you need to reload your crypto spending accounts.

Tangem’s Credit Card-Sized Hardware Wallet

James Bond would approve! This ultra-thin NFC-powered hardware wallet fits in your regular wallet alongside credit cards. Simply tap it against your phone to authorize transactions—no cables, no batteries required.

The physical card contains a secure chip similar to banking cards. If you’re nervous about phone thefts while traveling, Tangem provides peace of mind since nothing is stored on your mobile device.

Each card comes factory-sealed to prevent tampering.

Thailand’s TouristDigiPay System

Thailand leads the way with this government-supported system allowing tourists to convert crypto to Thai Baht through official channels. Scan QR codes to pay at participating businesses throughout Bangkok, Phuket, and beyond.

The regulated nature provides extra confidence for travelers worried about crypto’s sometimes gray legal status. As more countries develop similar systems, this represents the future of travel money.

Already accepted at over 10,000 locations across Thailand!